Les Form Military - 51. BAQ DEPN: Trust information is here. A = spouse, C = child, D = parent, G = grandparent, I = service member married to a service member, K = courtroom, L = offender, R = self, S = student 21-22

age , T = disabled child over 21, W = service member married to member, child under 21. Even if the release isn't on your site, it's a good idea to familiarize yourself with the LES.

Les Form Military

Source: www.science.org

Source: www.science.org

We've heard horror stories about spouses who found out their husbands had opted out of SGLI, and others whose accounts were mistakenly charged (surprise!) and the family didn't know until it was taken by the military personnel large salaries from their next salary.

Leave Information

One of the most frequently asked questions about withdrawals in the LES military is: What is AFRH? This is another type of insurance. If you have been selected for combat, the DoD pays $0.50 per month at the Army Post Office.

25. BF BAL: Stands for 'Balance of Flight Carried'. This is your remaining leave at the start of the financial year, or when you started active employment, or the day after your paid leave (LSL). Sometimes the military member has a lot of time to make these arrangements, and other times (for example, with no or little notice) they don't have enough time to do it.

all necessary actions. The POA may be available, but no copy of the LES. The holder of the POA must apply to the member's LES if necessary (unless the POA allows it in the restrictive language of the document).

DAY 23: Day of first enlistment. This date is used to identify which pension plan the service member is covered by. Today is not DFAS, but the HR department. If you believe the date is incorrect, contact them immediately.

Summary Net Pay

Field LES 11 is a total deduction from your paycheck. Deductions include taxes, insurance, and your TSP contributions. It's always a good idea to review your deductions to make sure nothing is being taken out of your paycheck that isn't necessary.

Source: www.ispionline.it

Source: www.ispionline.it

If you notice that something is being taken inappropriately, notify your HR or finance department STAT. If you arrive early, you may be able to get less money back than the loan from DFAS. There are two payments per month, the first and the 15th, unless one of the days is a holiday or weekend.

Payment days that fall on a holiday or weekend are paid on the last business day before the 1st or 15th. If you've ever been through an application, you know that one of the first things you'll be asked to do to get your family ready is to get a copy of your spouse's Leave and Income Statement (LES) — and

understanding. In this field, all come together. The formula for determining your net worth is earnings - deductions - distributions = net worth. The result is known as your end of month (EOM) payment. Your EOM is the net pay you take home each month.

Dfas Mypay System

The DFAS MyPay system allows service members to access pay and tax information, enroll in a savings plan, change or cancel TSP contributions, and view advice updates. trip. You can also view and print tax and travel information, update your account details and change tax withholdings.

Below are the military pay dates and LES release dates for 2023. Mid-month pay is the pay from the first day of the month to the 15th. The end-of-month payment is from the 16th to the end of the month.

11. DEDUCTION: This is where you will find everything that will be deducted from the service member's fee. Examples include taxes, SGLI, mid-month pay, and dental. If you have paid more than you have for a month, the higher amount will be shown here to be deducted.

(So, if your income seems low, check here first!) A portion of your deduction includes your federal and state taxes (if you pay income tax). The amount of tax deducted depends on different factors, such as your income and your exemptions.

Source: www.globalsecurity.org

Income Taxes

If you are in that category, you can use the 2021 salary tables to calculate how much federal tax is withheld from your salary and position. Your LES tells you about your military pay. It's the military style of a pay packet or pay slip.

It shows the amount of money you will receive during the pay period, the amount of tax withheld, your remaining leave and more. This means an overview of your costs and benefits. Usually a few days before each pay day you will be notified of your leave and earnings for the pay period.

Reviewing your LES is an important part of your monthly financial management. Most service members (or spouses) don't want to see your Leaving and Earnings Statement (LES). A square filled with blocks starts to merge. But these blocks are a complete record of your earnings and rights.

Knowing what these things mean will help you find errors that can cost you time and money if left undiagnosed for too long. Veteran.com is a property of Three Creeks Media. Neither Veteran.com nor Three Creeks Media is affiliated with or endorsed by the US Department of Defense or the Department of Veterans Affairs.

What Is A Military Les

Veteran.com content is created by Three Creeks Media, its partners, affiliates and contractors, and in no way do Veteran.com opinions or statements belong to the Department of Veterans Affairs, the Department of Defense , or to a government agency.

If you have questions about veterans programs offered by the Department of Veterans Affairs, visit their website at va.gov. The content provided on Veteran.com is for general informational purposes only and may not apply to the specific circumstances of customers.

This content should not be construed as legal or financial advice. If you have any questions, consider talking to a financial professional, accountant or attorney. Information on third-party products, rates and offers are subject to change without notice.

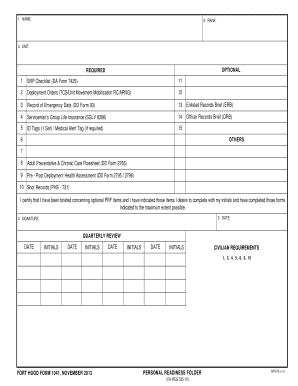

Source: www.pdffiller.com

Source: www.pdffiller.com

Check Leave and Income - The LES has a lot of coverage every month, but you need to review it and if there are any problems, fix them as soon as possible. Be sure to check your LES on the 1st and 15th of the month.

Here’s The Bottom Line

If you review it and find that your payment or any other field on your LES is significantly different, contact one of your financial affairs offices immediately. Regular review of the LES will help you identify and resolve problems early.

33. PAYMENTS: Amounts received under this LES are subject to federal taxes. Keep in mind that most of your benefits and earnings are not taxed, so this figure may not equal your total pay. If it's overpriced, DON'T spend the money!

I repeat, don't waste your money. I know it's tempting, but you'll be in trouble financially in the future. Keep the money in your checking account and notify your financial institution. LES has 78 fields. Yes, you are right.

LES has 78 blocks for you to know and understand. You don't need to memorize them all, but you do need to know your LES to recognize a problem. Your LES fields are divided into 11 main areas, which are: You'd be surprised how many service members I've helped solve financial problems due to LES errors.

Fields Through Contain Federal Tax Information

Realizing that you don't have any bills to pay, then your life and monthly budget will be in jeopardy. I'm not knocking DFAS, but mistakes happen - and people do. That's why it's important to check your LES regularly.

This will help you catch and solve problems in time. Here's what you need to know about your LES. 37. ADD'L TAX: If the service member has designated an additional amount to be withheld for federal taxes, it will be listed here.

Source: www.pdffiller.com

Source: www.pdffiller.com

(For example, if you owe taxes, you can download them here.) If you don't pay more, DFAS will pay you! It may not happen right away, but they will find out eventually, and when it does, they will want their money back as soon as possible.

You will not receive a return vote. It's taken directly from your paycheck, and is often a small monthly fee. The Notes section of your LES is a treasure trove of information about your payment. Whenever I review a service member's LES, the first thing I look at is the Notes section.

How To Read Your Les

This is the current events section of your pay, where you can quickly find out about current or upcoming changes to your leave and pay. The notes contain information from your bank name to the zip code where your BAH is located.

Taking a little time to read your notes can help you avoid financial problems in the future. 76. NOTES. As a financial guru, I would say this is the most important place for your vacation and income statement - LES.

It's basically a bulletin board about jobs in the military, your branch of service, your command, and your pay. The information also includes important explanations about changes to your rights, deductions and allowances. 61. TPC: This field is not used by active duty personnel.

The Reserve and Guard will find this field used to identify training program indicators: A = regular service member's regular pay status on regular duty; C = burial honors; M = annual training hours for 30 days;

Fields Through Have Leave Information

N = death; O = HPSP, ROTC and Special ADT training within 30 days; T = ADT for 29 days; U = graduate pilot training, advanced training, navigators and pre-flight training officers; X = HPIP Membership Scholarship or ROTC Membership;

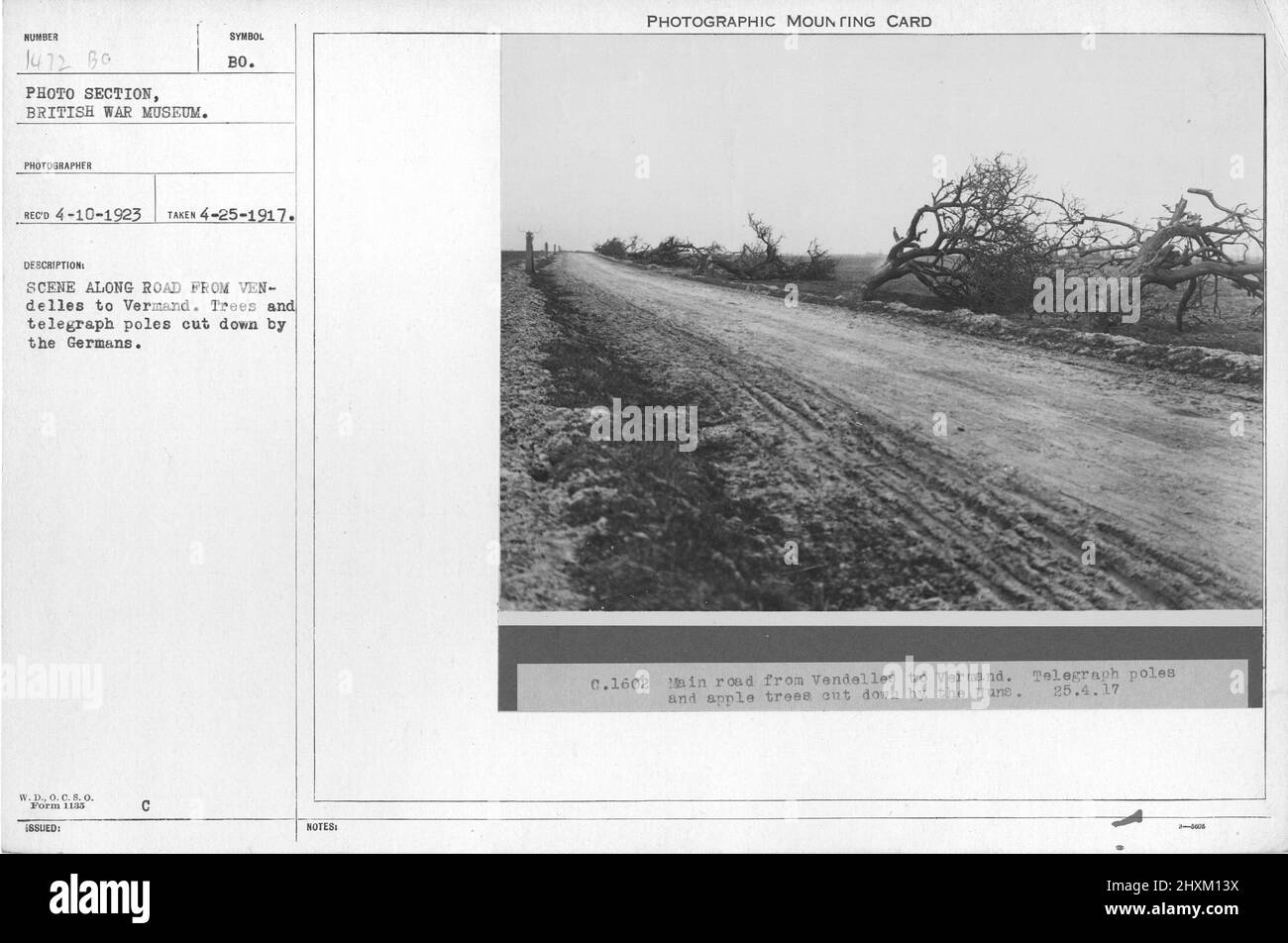

Source: c8.alamy.com

Source: c8.alamy.com

Z = Administrative training and support (not included). 59. BAS TYPE: This field indicates the type of BAS service the member receives. This field will be empty for owners. Everyone can see that B = Individual Benefits, C = TDY/PCS/Continuous Time, H = Non-Call Benefits, K = Emergency Benefits.

12. DISTRIBUTIONS: Distributions are limited, but all distributions coordinated by a service member can be found here. For example, there may be meaningful allocations for savings, retirement or investment accounts. Non-discretionary distributions, such as child support, may not be automatically deducted from wages.

There are many situations in which this can be an issue, but the most common are where the service member is deployed or has a medical condition that prevents the member from applying in person. 26. ERND: This is the amount of leave accrued in the fiscal year or during the current enlistment period if the service member has extended that half of the enlistment at the beginning of the fiscal year.

Investments In The Thrift Savings Plan

This means you get 2.5 vacation days per month. The LES is used in several ways—the lender will need a copy of the LES when you apply for a home loan, and you may need to show a copy to prove your military status.

while claiming the benefits of education while still working. You may be asked to provide someone at work to the provider if you are a Guard/Reserve member trying to request leave to respond to a call to work.

But sometimes the LES is not prepared by the military member. This may happen when the LES needs to apply for a home loan during the service member's absence or apply for benefits/privileges for a service member who is physically unable to work.

Advertisements: Veteran.com and Three Creeks Media, its parent companies and affiliates, receive fees for posting advertisements on Veteran.com; For any listing or listings on this site, Veteran.com will receive a fee from the listed companies, and that fee will apply to how, where, and what products and companies are listed.

appear in rows and rows. If a company is identified as a "partner" in a resume or listing, the company identified is a Veteran.com affiliate. No table, classification, or list is exhaustive or includes all companies or products available.

34. YTD PAYMENT: Your total annual income to date subject to government withholding. Payments such as basic allowance for housing (BAH) and basic subsistence allowance (BAS), which are not taxable, are not included in this calculation.

military les statement sample, dfas les dates, dfas form 702 explained, les military pay, military les pdf, les statement mypay, dfas form 702 military les, dfas les

0 Comments